Welcome to The Integrity Ledger — markets are flashing mixed signals, power is quietly shifting behind closed doors, and today’s moves may matter more than the headlines suggest.

Market commodities

Nasdaq | 23,508.46 | ▲ 0.34% |

S&P 500 | 6,896.89 | ▲ 0.30% |

|---|---|---|

Bitcoin | 87,784.30 | ▼ 0.80% |

Gold | 4,490.40 | ▼ 0.53% |

Dow Jones | 48,432.35 | ▲ 0.17% |

Ethereum | 2,951.40 | ▼ 1.82% |

Tether | 1.00 | ▲ 0.01% |

Binance Coin | 847.41 | ▼ 1.18% |

Solana | 124.32 | ▼ 1.18% |

Finance & Markets

US GDP Grows 4.3% in Q3 on Strong Spending and Investment

The US economy expanded at a 4.3% annualized rate in Q3, marking its fastest growth pace since 2023. Consumer spending, business investment in technology, and exports all contributed, while inflation remained above the Federal Reserve’s 2% target. The data complicates the Fed’s interest rate outlook amid mixed signals from the labor market and trade disruptions.

Robust GDP growth and persistent inflation are likely to temper the Federal Reserve’s pace of future rate cuts, with policymakers now projecting only one cut in 2026. Investors and businesses should prepare for sustained borrowing costs amid ongoing economic strength and elevated price pressures.

RBI Announces Rs 2 Lakh Crore Bond Buys and $10 Billion Swa

The Reserve Bank of India plans to inject Rs 2 lakh crore into the banking system through government security purchases carried out across four tranches between December 29, 2025, and January 22, 2026. Additionally, the RBI will conduct a $10 billion USD/INR buy-sell swap auction with a three-year tenor on January 13, 2026, to ease liquidity conditions amid evolving market dynamics.

These liquidity measures aim to stabilize financial markets and ensure adequate cash flow within the banking system. Investors and lenders may see improved market confidence while the RBI remains prepared to adjust interventions as conditions evolve.

Business & Investments

E.F. Hutton Advises on $19.5M RPM Interactive Acquisition

E.F. Hutton & Co. served as exclusive financial advisor to RPM Interactive in its all-stock merger with Avalon GloboCare Corp., valued at approximately $19.5 million. The deal combines RPM with Avalon Quantum AI, granting Avalon access to RPM's Catch-UpTM AI-driven content platform aimed at automating short-form digital video production.

The acquisition enhances Avalon's digital marketing by integrating RPM's AI content capabilities to support consumer wellness brands like KetoAirTM. For investors, the transaction underscores growing demand for AI-powered media technologies and strategic consolidation in the tech and health sectors.

Crypto & Fintech

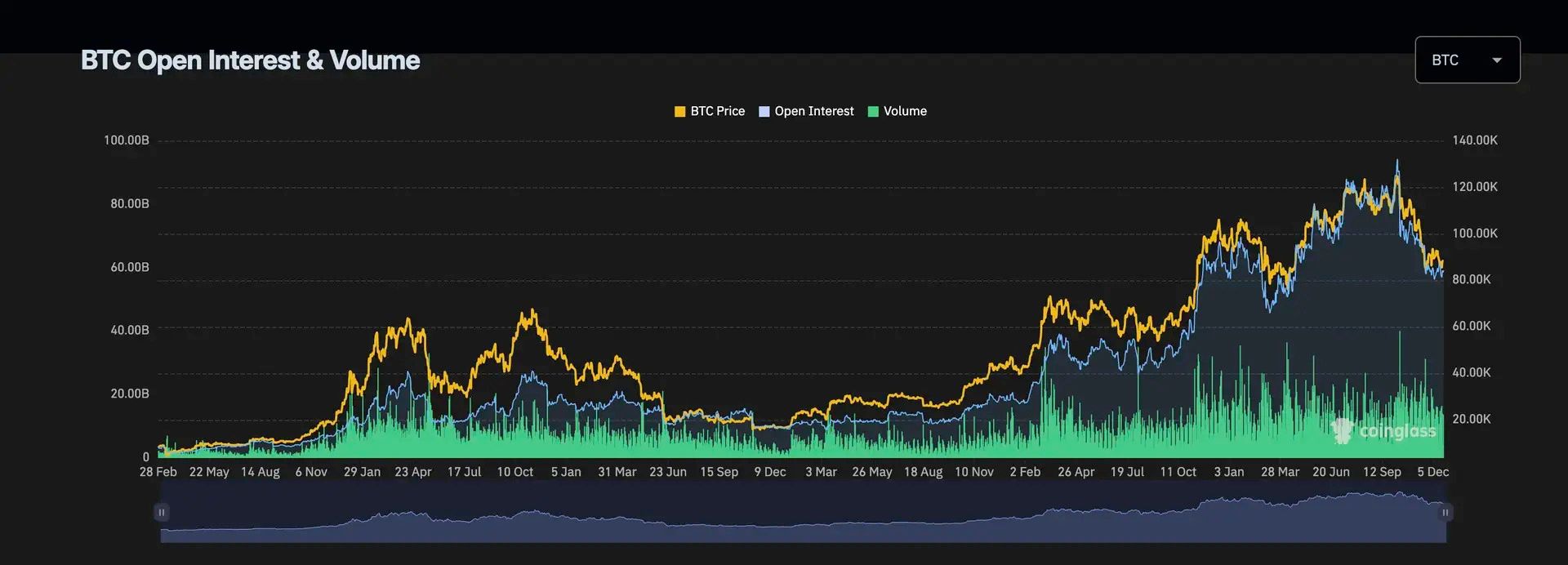

Record $23B Bitcoin Options Expire Dec. 26 Amid Volatility Risks

A historic $23 billion in Bitcoin options contracts are set to expire on December 26, marking the largest BTC options expiry on record. Market data from CoinGlass reveals calls stacked at high strike prices and puts clustered low, with the max pain price near current trading levels. Thin liquidity during the holiday week could amplify volatility as traders adjust positions.

This expiry is likely to provoke sharp Bitcoin price swings due to position unwinds amid reduced market liquidity. Institutional derivatives flows are increasingly shaping Bitcoin's price dynamics, highlighting the growing influence of large investors during major contract settlements.

ServiceNow to Acquire Cybersecurity Startup Armis for $7.75 Billion

ServiceNow announced a $7.75 billion cash acquisition of cybersecurity startup Armis to enhance its security capabilities amid rising AI threats. The deal, expected to close in the second half of next year, will more than triple ServiceNow's market opportunity for security and risk solutions. Armis reported over $340 million in annual recurring revenue, growing 50% year-over-year.

This acquisition strengthens ServiceNow's position in cybersecurity as companies invest heavily to mitigate AI-driven threats. Integration of Armis’ technology is poised to deliver comprehensive real-time protection, expanding ServiceNow’s offerings in a competitive market facing growing cyber risk. The transaction reflects ongoing consolidation in cybersecurity aimed at accelerating innovation and market reach.

Emerging Tech & Ethics

AI to Transform Business with Relationship Intelligence and Org Integration in 2026

AI expert Rana el Kaliouby predicts 2026 will see AI deepen human connections through relationship intelligence tools that organize and contextualize disparate data. She also foresees AI integrated directly into organizational structures, managing hybrid human-AI teams and reshaping roles, hiring, and performance management.

Businesses should prepare for AI becoming a core collaborator rather than just a tool, requiring new approaches to management and culture. Companies building proprietary data moats around AI relationship intelligence could gain competitive advantages. Employees fluent in AI will gain career flexibility as job functions evolve dramatically.

Cyberattack Disrupts France's Postal and Digital Banking Services

La Poste, France's national postal service, experienced a major network incident on Monday that knocked all its information systems offline, disrupting online banking and postal services for millions. The outage affected the main website, mobile app, digital identity service, and the Digiposte platform. La Banque Postale confirmed its online and mobile services were down, though essential banking operations including ATM withdrawals and card payments continued functioning.

The nationwide disruption highlights vulnerabilities in critical public infrastructure amid rising cyber threats. Businesses and consumers relying on La Poste's digital services faced significant inconvenience and potential risks. This incident underscores the need for enhanced cybersecurity measures and contingency planning in government-linked entities.

Forensic Lens

Money Trails

GreenTree Hospitality Group Ltd. reported a 15.0% year-over-year decrease in total revenues to RMB303.6 million (US$42.6 million) for Q3 2025. Income from operations declined to RMB70.1 million (US$9.8 million) from RMB106.4 million in Q3 2024, while net income dropped to RMB60.3 million (US$8.5 million). Adjusted EBITDA decreased 6.1% to RMB115.0 million (US$16.1 million), with cash from operations rising 3.8% to RMB144.5 million (US$20.3 million).

The decline in revenue reflects lower occupancy rates and average daily room rates amid closures of leased-and-operated (L&O) hotels and restaurants. However, disciplined cost management improved adjusted EBITDA margin to 37.9%. Investors should watch the hotel segment's recovery prospects as GreenTree maintains a cautious full-year revenue guidance with expected declines between 10-13%. Operational cash flow growth signals robust underlying liquidity despite ongoing market headwinds.

Corruption & Governance

Protesters in Tirana hurled petrol bombs at the government building on Monday, demanding the resignation of Prime Minister Edi Rama's government following corruption charges against Deputy Prime Minister Belinda Balluku. Balluku, who also leads the Ministry of Infrastructure, is accused of using state funds to favor certain companies in infrastructure projects worth hundreds of millions of euros. The Special Prosecution Office has requested parliament to lift her immunity to allow her arrest.

The charges and ensuing unrest highlight growing political instability in Albania, potentially disrupting critical infrastructure projects. The government's response and the parliamentary vote on immunity will be pivotal in shaping investor confidence and Albania’s governance outlook.

Fraud Watch

Chaitanya Baghel, son of former Chhattisgarh Chief Minister Bhupesh Baghel, allegedly obtained between Rs 200 crore and Rs 250 crore from a large liquor extortion racket during the Congress regime, according to the state Anti-Corruption Bureau/Economic Offences Wing. The latest 3,800-page chargesheet details his role in orchestrating the scam alongside senior officials, contributing to illicit gains estimated above Rs 3,000 crore.

The case exposes deep-rooted corruption involving high-level officials and significant financial irregularities in state excise operations. Prosecution and asset recovery efforts may intensify scrutiny of political figures and deter future abuses within regulatory departments.

Global Integrity Outlook

Global

Radware announced the results of its 2025 Annual General Meeting held on December 22, 2025, where shareholders approved three out of four proposals. The rejected proposal involved compensation terms and equity grants for non-employee directors. Radware continues to lead in AI-driven application security for multi-cloud environments amid ongoing geopolitical and economic risks.

US

The U.S. will impose tariffs on Chinese semiconductor imports starting June 2027, following a year-long investigation led by the U.S. Trade Representative. This move addresses unfair competition concerns in the chip industry and may serve as a trade pressure tool amid ongoing U.S.-China talks. The specific tariff rates will be announced a month before implementation.

China

A draft Pentagon report reveals China likely deployed over 100 intercontinental ballistic missiles near its Mongolian border, part of a rapid nuclear expansion aiming for 1,000 warheads by 2030. The report highlights China's military buildup with no interest in arms control talks, raising concerns about regional and global security ahead of the New START treaty expiration.

Latin America

The U.S. is actively pursuing the Panama-flagged oil tanker Bella 1 off Venezuela's coast as part of a total blockade on Venezuelan oil exports, targeting vessels violating sanctions linked to President Nicolás Maduro. This blockade disrupts Venezuela’s oil-dependent economy, risking a severe recession and increased migration amid escalating U.S. pressure on Maduro’s regime.

Quick Bits / Short Reads

The U.S. economy grew at a robust 4.3% annual rate in Q3 2025, outperforming forecasts due to rising government and consumer spending and exports, while core PCE inflation edged up to 2.9%, complicating prospects for January Fed rate cuts. — Fast Company

The Conference Board reports U.S. consumer confidence fell 3.8 points to 89.1 in December 2025, with concerns about inflation and tariffs persisting amid a stable but subdued jobs outlook and weaker sentiment on current economic conditions. — CBS News

The U.S. stock market edged higher as the economy’s Q3 GDP growth of 4.3% surprised markets, leading traders to reduce expectations for near-term Fed rate cuts, while commodities rallied with copper surpassing $12,000 per ton amid robust industrial demand. — The Economic Times

U.S. companies issued nearly $1.7 trillion in investment-grade bonds in 2025, driven by AI infrastructure investments from Big Tech and record corporate borrowing that may push 2026 issuance beyond pandemic levels, raising concerns over a potential debt glut. — Financial Post

CDT Environmental Technology reported a 42.3% revenue decline to $7.3 million in H1 2025 amid reduced demand and strategic shifts to green hydrogen and waste-to-energy projects, resulting in a net loss of $1.3 million versus prior-year net income. — Benzinga

Barnes & Noble Education filed its "Super 10-K" disclosing fiscal 2025 results including 2.7% revenue growth to $1.6 billion, a $65.8 million net loss, a 25.3% rise in BNC First Day program revenue, and improved net debt lowered by $92 million year-over-year. — Benzinga

Adani Ports raised its FY26 EBITDA guidance to ₹22,350–23,350 crore and cargo volume outlook to 545–555 million tonnes following the acquisition of Australia's North Queensland Export Terminal, aiming for 1 billion tonnes throughput by 2030. — The Economic Times

Stay sharp, stay ethical, and keep following the money.

— The Integrity Ledger Team