Welcome to The Integrity Ledger — Markets hover near records as Venezuela’s oil reshapes geopolitics, crypto faces fresh scrutiny, corporate power plays intensify, and corruption probes widen globally. Today’s briefing tracks where money, influence, and accountability collide.

Market commodities

Nasdaq | 23,711.58 | ▲ 0.70% |

S&P 500 | 6,959.98 | ▲ 0.20% |

|---|---|---|

Bitcoin | 91,522.91 | ▼ 2.36% |

Gold | 4,469.60 | ▼ 0.11% |

Dow Jones | 49,327.25 | ▼ 0.29% |

Ethereum | 3,160.27 | ▼ 4.16% |

Tether | 1.00 | ▼ 0.05% |

Binance Coin | 899.65 | ▼ 1.96% |

Solana | 135.99 | ▼ 3.64% |

Finance & Markets

Dow and Nasdaq Near Records Amid Venezuela Oil Shift and Cooling Inflation

The Dow Jones Industrial Average reached an intraday record above 49,300 before closing down 240 points at 49,221.89, while the S&P 500 edged down 0.10% to 6,937.81 and the Nasdaq rose 0.13% to 23,578.05. Strengthening U.S. economic data, easing inflation pressures, and a geopolitical shift involving the transfer of 50 million barrels of Venezuelan oil to the U.S. have driven market resilience early in 2026. Investors remain cautiously optimistic despite modest index pullbacks amid a calmer global risk environment.

The influx of Venezuelan oil is expected to lower input costs for U.S. refiners, boosting shares like Valero Energy and Marathon Petroleum. Continued easing inflation alongside steady economic momentum could encourage the Federal Reserve toward a flexible policy stance this year. Moreover, sustained geopolitical stability in the Middle East and Latin America supports positive investor sentiment and market breadth going forward.

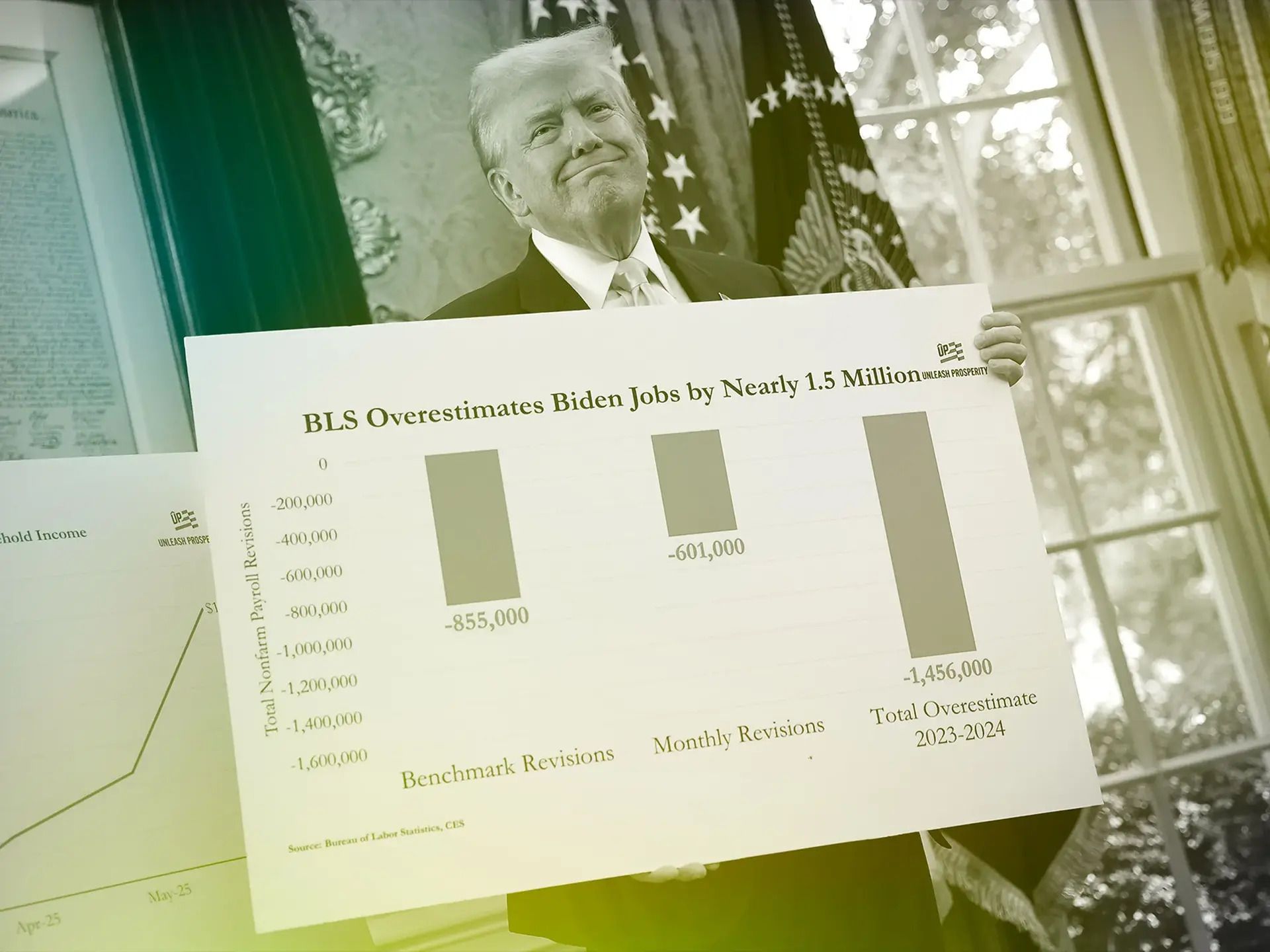

BLS Faces Staffing Crisis, Raising Concerns Over US Economic Data

The Bureau of Labor Statistics confirmed a 25% drop in staffing and 40% of leadership roles currently vacant, validating economists’ concerns about deteriorating data quality after the 2025 federal shutdown. This staffing shortfall coincides with reports of delayed and less reliable economic data, intensifying skepticism around recent GDP growth figures.

Investors relying on government data may face increased uncertainty as staffing gaps and shutdown-related delays undermine data accuracy. Market optimism, reflected in record-low cash holdings and rising equity ETFs, could be vulnerable to significant future revisions of economic indicators.

Business & Investments

Warner Bros. Rejects Paramount Bid, Endorses Netflix Offer

Warner Bros. Discovery once again rejected Paramount’s $77.9 billion hostile takeover bid, urging shareholders to support Netflix’s $72 billion offer for its studio and streaming businesses. Paramount has increased its bid and secured a $40.4 billion equity financing guarantee from Oracle’s Larry Ellison, but Warner’s board deemed Paramount’s proposal not in shareholders’ best interests.

The competing bids highlight divergent strategic visions: Netflix seeks only Warner’s studio and streaming assets, while Paramount aims to acquire the entire company, including CNN and Discovery networks. Both deals face intense antitrust scrutiny from U.S. and global regulators, which could delay or derail the transaction, creating ongoing uncertainty for investors.

Crypto & Fintech

Alleged Crypto Scam Leader Linked to $15 Billion Bitcoin Deported

Authorities deported a suspect accused of leading a $15 billion bitcoin scam back to China following an arrest in Cambodia. This case highlights ongoing controversies surrounding the origin and ownership of billions in seized cryptocurrency.

The deportation intensifies scrutiny of large-scale bitcoin seizures and complicates cross-border regulatory efforts. Stakeholders in crypto markets should monitor evolving legal precedents affecting asset recovery and enforcement actions.

Bitchat Downloads Surge in Uganda Amid Election Internet Shutdown Fears

Ahead of Uganda's presidential elections next week, Bitchat app downloads surged to cover about 1% of the population, driven by opposition leader Bobi Wine's call to preemptively adopt the mesh-network messaging platform. The app, created by Jack Dorsey, enables messaging via Bluetooth-powered peer-to-peer networks, bypassing traditional internet infrastructure and resisting shutdowns similar to Uganda's four-day blackout in 2021.

Bitchat's rise highlights growing reliance on decentralized communication tools to maintain connectivity during government-imposed internet restrictions. This trend stresses the challenges authorities face in controlling digital communications, pushing users and activists toward resilient mesh networking and satellite alternatives like Starlink despite regulatory hurdles.

Emerging Tech & Ethics

Seven Ways the CIO Role Will Transform in 2026

The CIO role is evolving rapidly as AI moves from experimentation to large-scale enterprise transformation. Experts highlight seven key changes for 2026, including shifting from IT manager to business strategist, leading change management, modernizing data infrastructure, making strategic build-versus-buy decisions, selecting scalable AI platforms, and driving new AI-powered revenue streams.

CIOs must lead organizational shifts by embedding AI into core processes and culture while balancing innovation with data security and governance. Their expanded role as business strategists and revenue drivers will require continuous adaptation of skills and technology choices to maintain competitive advantage in a fast-changing AI landscape.

Momentum Cyber Releases Sixth Annual Almanac Highlighting AI Security Surge

Momentum Cyber released its sixth annual Cybersecurity Almanac, revealing a new capital super cycle driven by AI-era infrastructure needs. The report, based on data from over 6,000 companies and 14,000 transactions, notes record $96 billion in cybersecurity M&A during 2025, with cloud-native firms capturing 97% of deal value amid accelerating platform consolidation.

This almanac underscores cybersecurity's evolving role as foundational AI infrastructure, guiding CEOs, investors, and boards on where capital is concentrating and which segments command premium valuations. The trends signal continued strategic M&A and investment focus on cloud-native security models and AI security platforms throughout 2026.

Forensic Lens

Money Trails

UniFirst Corporation posted first-quarter fiscal 2026 revenues of $621.3 million, a 2.7% increase driven by organic growth in its Uniform & Facility Service Solutions segment. Despite revenue gains, net income declined to $34.4 million from $43.1 million a year earlier, with diluted earnings per share dropping to $1.89 from $2.31 due to planned investments in growth and digital transformation. The company reaffirmed full-year guidance of $2.475–$2.495 billion in revenue and $6.58–$6.98 earnings per share.

UniFirst’s strategic investments, while compressing near-term margins, aim to enhance scalability and profitability over time. Share repurchases and dividend increases highlight the company's commitment to shareholder returns amidst growth initiatives. Investors should monitor the impact of ongoing digital transformation and customer acquisition efforts on long-term financial performance.

Corruption & Governance

Tamil Nadu Government has directed the Directorate of Vigilance and Anti-Corruption (DVAC) to investigate allegations of bribery linked to contracts awarded in the Municipal Administration and Water Supply department under Minister K.N. Nehru. The Enforcement Directorate (ED) alleges ₹1,020 crore in bribes, possibly more, associated with rigged tenders and recruitment irregularities. The minister denies the claims, accusing the ED of political bias.

This probe could impact governance and contract award processes within the state’s MAWS department, highlighting vulnerabilities in public procurement oversight. For contractors and officials, increased scrutiny and potential legal consequences loom. The case underscores ongoing tensions between political actors and federal investigative agencies in India.

Fraud Watch

House Judiciary Chair Jim Jordan accuses Minnesota Democrats, including Governor Tim Walz and Attorney General Keith Ellison, of actively assisting a $250 million Feeding Our Future fraud scheme rather than it being an oversight failure. The scandal involves whistleblower warnings, suspended payments, race-based pressure, and political donations amid ongoing federal investigations. Walz and Ellison are expected to testify as scrutiny intensifies over alleged corruption and misuse of taxpayer funds.

The allegations highlight potential systemic corruption and politicized pressure influencing fraud oversight in public programs. Investors, policymakers, and watchdogs should anticipate deeper federal probes and increased calls for accountability in government-funded initiatives.

Global Integrity Outlook

Global

The US plans to control Venezuela's oil exports indefinitely, with President Trump announcing that Venezuela will relinquish up to 50 million barrels of oil valued at about $2.8 billion. Proceeds from these sales are intended to rebuild Venezuela's economy, with US oil firms potentially aiding production if government stability is ensured.

US

A Minnesota audit uncovered $425 million in grants within the Department of Human Services' Behavioral Health Administration lacking oversight, with fabricated documents and missing monitoring visits. The report implicates top officials including Gov. Tim Walz, who subsequently dropped his re-election bid amid a massive fraud scandal potentially totaling $9 billion. The findings call for a leadership overhaul and improved accountability in managing state grants.

Asia

Malaysia's MACC recovered 2.4 million ringgit linked to a bribery probe involving military procurement, with former army chief Muhammad Hafizuddeain Jantan questioned amid the investigation. The probe exposed systematic kickbacks and favoritism in defence contracts, triggering leadership changes as new Chief of Staff Azhan Md Othman assumes command. This case highlights corruption risks in defence spending and drives calls for enhanced transparency.

Quick Bits / Short Reads

The U.S. Department of Education resumes federal student loan wage garnishments in January 2026, beginning with 1,000 borrowers out of over 5.5 million in default, with up to 15% of disposable income withheld to recover approximately $140 billion in defaulted debt. — The Economic Times

Eurozone inflation cools to 2% in December 2025, matching the European Central Bank’s target as core inflation falls to 2.3%, signaling a steady normalization of price growth amid easing energy costs. — Firstpost

The Nasdaq gains 0.71% with Innovative Eyewear and biotech stocks surging, while materials stocks fall 1.5%; the ISM services PMI rises to 54.4 in December, indicating service sector expansion, amid crude oil declining 2% to $56.01 per barrel. — Benzinga

Wall Street faces mixed trading as the S&P 500 pauses after record highs, bond yields fall globally, and US services grow at the fastest pace in over a year, overshadowed by geopolitical tensions including US-Venezuela oil dealings. — Financial Post

Warner Bros. rejects Paramount’s $77.9 billion hostile takeover bid again, urging shareholders to support its existing $72 billion streaming and studio sale to Netflix amid regulatory and political scrutiny. — Wcpo

The global anti-jamming market, valued at $5.43 billion in 2024, is projected to grow at an 8.6% CAGR to reach $9.9 billion by 2032, driven by rising defense budgets, satellite communications, and autonomous vehicle demands. — Benzinga

ASP Isotopes completes acquisition of Renergen, positioning the combined company to become a global critical materials provider with $750 million in committed US debt funding to expand helium production for semiconductors, quantum computing, and clean energy markets. — Benzinga

Eli Lilly is in advanced talks to acquire biotech firm Ventyx Biosciences for over $1 billion, aiming to expand its portfolio with Ventyx’s therapies targeting Crohn’s, rheumatoid arthritis, Parkinson’s, and cardiovascular diseases linked to obesity. — Stat

Stay sharp, stay ethical, and keep following the money.

— The Integrity Ledger Team