Welcome to the Integrity Ledger — Markets shudder as tariffs loom, inflation surprises, crypto systems falter, and corruption probes widen. From AI governance alarms to global power plays, today’s signals hint at hidden risks shaping money, trust, and accountability worldwide ahead.

Market commodities

Nasdaq | 23,515.39 | ▼ 0.06% |

S&P 500 | 6,940.01 | ▼ 0.06% |

|---|---|---|

Bitcoin | 93,159.37 | ▼ 0.49% |

Gold | 4,680.70 | ▲ 1.73% |

Dow Jones | 49,359.33 | ▼ 0.17% |

Ethereum | 3,216.71 | ▼ 1.93% |

Tether | 1.00 | ▼ 0.02% |

Binance Coin | 927.33 | ▼ 0.56% |

Solana | 134.14 | ▼ 2.77% |

Finance & Markets

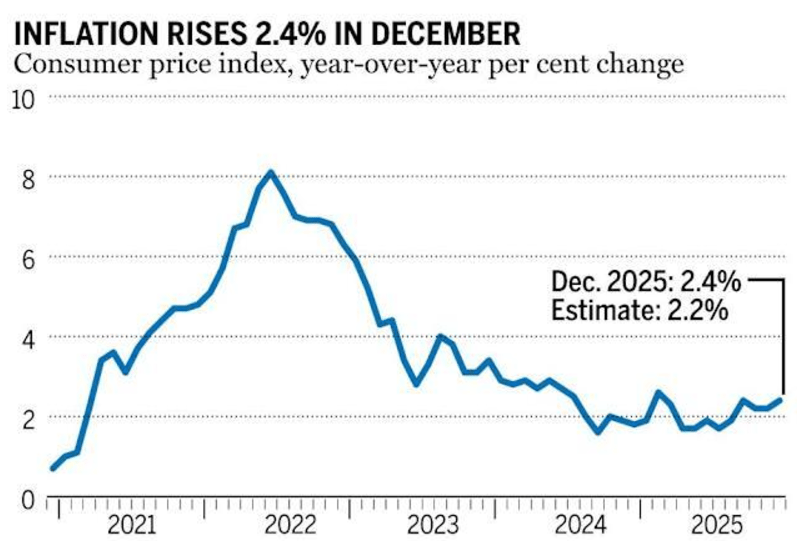

Canada's December CPI Rises 2.4% Year-on-Year Exceeding Forecast

Canada's December consumer price index (CPI) increased 2.4% year-on-year, above the expected 2.2%, while monthly inflation fell 0.2%. Core inflation measures showed modest cooling with the Bank of Canada (BOC) core at 2.8% annually and a monthly decline of 0.4%. Higher restaurant and grocery prices, including a 5.0% rise in grocery costs and sharp spikes in frozen beef and coffee, contributed to inflation pressures despite falling travel and rent expenses.

The unexpected CPI rise slightly increases the likelihood of a rate hike by the Bank of Canada in 2024. Persistent inflation in essential goods like food and shelter suggests monetary policymakers face challenges achieving their 2% target, potentially influencing borrowing costs and market expectations going into 2026.

Trump's Greenland Tariffs Trigger Risk-Off Sentiment in Markets

President Trump announced plans to impose a 10% tariff on European goods from February 1, potentially rising to 25% by June, in response to European involvement in Greenland affairs. This escalation has rattled markets, with S&P 500 futures down 1%, European indices falling over 1%, and the US dollar weakening against key currencies. Precious metals surged, with silver jumping over 3% past $93 and gold rising nearly 2% to $4,670, reflecting investor flight to safe havens amid rising geopolitical risks.

The tariffs threat is intensifying geopolitical uncertainty, pressuring equity markets and fueling demand for precious metals as currency debasement fears rise. Investors may favor Swiss francs and precious metals for diversification, while global trade tensions could impact European exports starting in February. Market participants should monitor developments ahead of the World Economic Forum in Davos and Japan's snap election on February 8 as catalysts for further volatility.

Business & Investments

Zurich Makes £7.7 Billion Bid for Beazley, Shares Soar 40%

Zurich Insurance has launched a £7.7 billion takeover bid for Lloyd's of London underwriter Beazley, offering 1280p per share after a previous 1230p offer was rejected. Beazley shares jumped over 40% to a record 1170p, reflecting strong investor interest in the specialist insurer. Zurich aims to create a global specialty insurance leader with combined premiums of about £11 billion.

This takeover highlights growing consolidation in the UK insurance sector and underscores the attractiveness of UK-listed companies to international buyers. Investors may see renewed activity and elevated valuations in the London market as strategic deals accelerate throughout 2026.

Crypto & Fintech

Paradex Glitch Causes Bitcoin Price Error, Mass Liquidations, Rollback

On January 19, Paradex, a decentralized perpetuals exchange on Starknet, erroneously priced Bitcoin at $0 due to a faulty database migration, triggering widespread liquidations. The platform halted operations for eight hours and executed a blockchain rollback to block 1,604,710 to restore user positions before the maintenance. Starknet’s token dropped 3.6%, while Bitcoin traded down 2.17% after the incident.

The rollback undermines blockchain immutability, raising concerns about decentralization and counterparty risk on DeFi derivatives platforms. Market participants are expected to scrutinize appchain governance and emergency protocols, potentially shifting volumes toward platforms with stronger operational resilience.

Revolut Applies for Peru Banking License to Expand Latin America

Britain's Revolut has applied for a full banking license in Peru, marking its fifth expansion into Latin America. Valued at $75 billion, Revolut aims to reach 100 million customers by 2027 and is targeting the region's underbanked population with digital financial services. The London-based firm already operates in Brazil, Mexico, Colombia, and Argentina and recently obtained a crypto license in Cyprus.

Securing a banking license in Peru will enable Revolut to offer localized products and deepen its presence in the rapidly digitizing Latin American markets. This move signals heightened competition in the region’s digital banking sector and highlights opportunities driven by widespread smartphone usage and unmet financial needs.

Emerging Tech & Ethics

OpenAI’s Lehane Warns AI Governance Is Global Emergency

At BT Davos 2026, Christopher Lehane, OpenAI’s Chief Global Affairs Officer, highlighted the accelerating global AI race and called governance a critical global emergency. He stressed the rapid AI advances, safety and ethics concerns, risks of misaligned AI behavior, and the need for global leadership to ensure responsible AI deployment.

Lehane’s insights underscore urgent action required from policymakers and institutions worldwide to manage AI’s risks and benefits. Emerging economies like India must prioritize AI and automation to stay competitive amid the intensifying technology arms race.

Ingram Micro Reports Ransomware Attack Affecting 42,000 Individuals

Ingram Micro disclosed a ransomware attack in July 2025 that compromised personal data of over 42,000 people. The breach exposed sensitive information including Social Security numbers and employment records, triggering a significant outage of internal systems and prompting a shift to remote work. The SafePay ransomware gang claimed responsibility, stealing 3.5TB of data and posting it on their dark web leak site.

This incident underscores the growing threat of double-extortion ransomware targeting major technology firms, highlighting the need for robust cybersecurity defenses. Businesses should enhance incident response strategies and data protection to mitigate risks of similar high-impact attacks.

Forensic Lens

Money Trails

PolyPeptide Group AG (PLYGF) reported full-year 2025 revenue of EUR 389 million. The company ended the year with EUR 75 million in cash and cash equivalents and an additional EUR 51 million available under its EUR 151 million revolving credit facility.

The strong liquidity and undrawn credit provide PolyPeptide with financial flexibility to support future growth and operational needs. This robust cash position may enable continued investments and strategic initiatives in the coming fiscal year.

Corruption & Governance

The Trump administration's first U.S. sale of Venezuelan crude oil, valued at roughly $250 million, was made to Vitol, an energy trading firm linked to John Addison, a senior trader who donated $6 million to Trump's 2024 campaign. Critics highlight Addison’s pledge at a White House meeting to leverage U.S. influence over Venezuela for favorable pricing, raising concerns over conflicts of interest and potential corruption with proceeds reportedly funneled to offshore accounts in Qatar.

This deal exemplifies how political donations can influence access to lucrative government contracts, raising risks of unchecked corruption and nepotism. The arrangement exposes vulnerabilities in oversight of foreign asset sales and could provoke regulatory scrutiny and reputational damage for involved parties.

Fraud Watch

The Enforcement Directorate has summoned YSRCP MP PV Midhun Reddy for questioning on January 23 in connection with a ₹3,500 crore money laundering probe linked to Andhra Pradesh's liquor policy from 2019 to 2024. Former MP Vijayasai Reddy is also summoned for questioning in the case, which alleges kickbacks to former Chief Minister YS Jagan Mohan Reddy. Multiple chargesheets filed by the Andhra Pradesh SIT claim illegal siphoning of kickbacks averaging ₹50-60 crore per month.

The ongoing investigation exposes systemic corruption within the state's liquor trade, underscoring risks for political actors in regulatory oversight roles. For investors and policymakers, this case highlights the importance of transparency and governance reforms to prevent large-scale money laundering in state-controlled sectors.

Global Integrity Outlook

Global

President Donald Trump threatened European nations with tariffs if they oppose his plans to control Greenland, asserting the world is not safe without US dominance over the Arctic island. European leaders condemned the threats as blackmail and prepared countermeasures, while Greenland affirmed its sovereignty and resistance to pressure. This dispute escalates tensions within the transatlantic alliance and highlights strategic interests in the Arctic.

Russia

AAP National Convenor Arvind Kejriwal criticized BJP's 30-year rule in Gujarat, accusing it of corruption, oppression, and looting public resources. He asserted only AAP can defeat BJP in the 2027 elections, highlighting Congress's ties to BJP through government contracts. Kejriwal also condemned the imprisonment of AAP leaders and misuse of tribal welfare funds for political rallies.

Latin America

After the U.S. strike and the ousting of Venezuelan President Nicolás Maduro, interim leader Delcy Rodríguez is engaging pragmatically with the U.S., signaling reforms and new foreign investment in Venezuela’s energy sector. This shift raises questions about the survival of the Chavismo movement, which faces economic collapse, corruption, and waning popular support after decades of leftist rule.

Asia

China's population declined by 3.39 million in 2025 to 1.405 billion due to a 17% drop in birth rates to 7.92 million, the lowest since 1949. Despite government incentives like raising child limits and financial bonuses, rapid aging persists with over-60s making up 23%, straining the workforce and pension system.

Quick Bits / Short Reads

The Eurogroup meeting may announce a new ECB Vice President today, with Mário Centeno of Portugal as the frontrunner amid challenging political negotiations requiring support from 16 of 21 countries. — Forex Live

Canada's December inflation rose to 2.4% led by a federal GST/HST holiday, while core inflation measures cooled, leaving economists divided on whether the Bank of Canada will hold or cut interest rates amid signs of disinflation momentum. — Financial Post

US stock futures dropped 1.2% following Trump's Greenland ultimatum and tariff threats on seven EU countries, raising concerns over the potential breakdown of global intellectual property protections under the EU Anti-Coercion Instrument. — Forex Live

Brookings economist Robin Brooks warns of a “thoroughly alarming” spike in long-term government bond yields across the G10 nations, signaling potential sovereign debt crises despite recent drops in short-term rates; US 10Y Treasury yields sit at 4.22%. — Benzinga

Madhya Pradesh is hailed by Japan Bank for International Cooperation as a highly attractive destination for Japanese investors, particularly in renewable energy and infrastructure, during discussions at the World Economic Forum in Davos. — Asianet Newsable

Regenx Tech Corp. reports a prolonged audit due to expanded scope, extends debentures maturing in January 2026 to January 2027, and notes operational leadership changes at its Newport, Tennessee facility. — Globe News wire_fr

The National Company Law Appellate Tribunal upholds Adani Power’s Rs 4,000 crore acquisition of Vidarbha Industries Power, dismissing petitions against the resolution plan as compliant with the Insolvency & Bankruptcy Code. — The Economic Times

Advanta Enterprises files draft red herring prospectus with SEBI for an IPO comprising a 3.61 crore share Offer-for-Sale by existing shareholders, including promoters UPL Ltd, without fresh issue proceeds to the company. — The Economic Times

The Integrity Ledger is published by the International Institute of Certified Forensic & Integrity Professionals, a global network exposing fraud, corruption, and financial crime.

Stay sharp, stay ethical, and keep following the money.

— The Integrity Ledger Team